Reservoir Media (RSVR)·Q3 2026 Earnings Summary

Reservoir Media Q3 FY2026 Earnings: Revenue Beat, EPS Miss, Guidance Raised

February 4, 2026 · by Fintool AI Agent

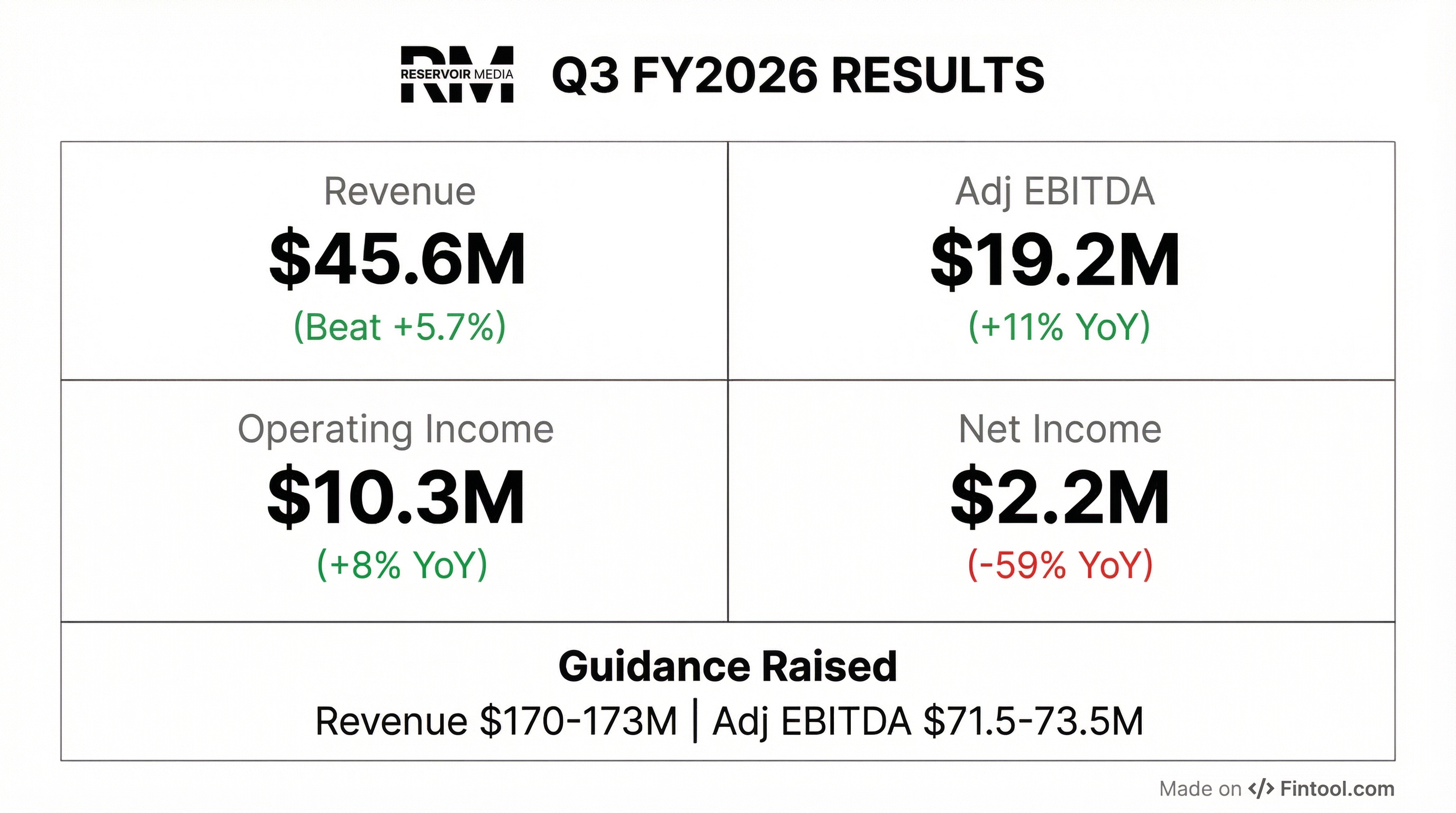

Reservoir Media (NASDAQ: RSVR) reported mixed Q3 FY2026 results on February 4, 2026, beating revenue consensus by 5.6% while missing EPS estimates significantly due to non-operational headwinds. Organic growth was 5% YoY, with total revenue up 8% including acquisitions. The independent music company raised full-year guidance for both revenue and Adjusted EBITDA, signaling confidence in its diversified catalog strategy.

Did Reservoir Media Beat Earnings?

Revenue beat; EPS missed on below-the-line items.

Values with asterisk () retrieved from S&P Global.*

The revenue beat was driven by double-digit growth in Music Publishing (+12% YoY) and strong Digital streaming momentum across both segments.

The EPS miss, however, requires context. Net income fell 59% YoY to $2.2M despite revenue and operating income growth. The culprits:

- Swap losses: A $270K loss on interest rate swaps vs. a $3.1M gain in Q3 FY25

- Higher interest expense: Up $807K YoY as debt increased to fund acquisitions

- Other income reversal: ($103K) expense vs. $509K income last year

These are non-cash or financing-related items that don't reflect operating performance. Management's preferred metric—Adjusted EBITDA—grew 11% to $19.2M.

What Changed From Last Quarter?

Several key developments this quarter:

Performance revenue was the standout—up 42% YoY in Music Publishing, driven by hit song royalties. This high-margin stream helped expand Publishing OIBDA margin from 34% to 37%.

New deals announced:

- Gladys Knight — R&B legend; income streams across publishing and master recording catalogs

- T.I. — Hip-hop icon; publishing back catalog + future works, recorded music interests including masters, artist royalties, and neighboring rights

- Bertie Higgins — Yacht rock icon; publishing + recorded music rights including "Key Largo"

- Say She She — Global publishing deal; female-led discodelic soul band

- Allison Veltz Cruz & Britten Newbill — Country pop and pop/R&B songwriters

- DIVINE extension — Multi-platinum Indian hip-hop artist through Pop India subsidiary

- Abood Music / Skatta Burrell JV — Jamaican music joint venture; "Coolie Dance Riddim" catalog

Miles Davis Centennial (January 2026 launch): Lexus ad campaign, centennial logos, cigar partnership with Ferio Tego, John Varvatos merchandise deal, centennial autobiography edition, live performances.

Grammy wins: Reservoir roster contributed to 10 Grammy wins including Best R&B Song/Performance ("Folded" by Kehlani), Best Folk Album (I'm With Her), Best Historical Album (Joni Mitchell), and Best Album Notes (Miles Davis).

Industry backdrop: The global value of music copyright reached an all-time high of $47.2 billion, with streaming services continuing regular price increases.

How Did the Stock React?

RSVR shares closed at $7.22 on February 3, 2026, and fell 1.8% in aftermarket trading to $7.09 following the earnings release.

The muted reaction suggests the market is weighing the revenue beat and raised guidance against the EPS miss and elevated debt levels. Total debt stands at $452M with Net Debt of $432M—up from $367M at fiscal year start.

What Did Management Guide?

Reservoir raised both revenue and Adjusted EBITDA guidance for FY2026.

CFO Jim Heindlmeyer stated: "Our financial results through the first three fiscal quarters underscore the strength of our portfolio of talent and our disciplined approach to sourcing deals with strong fundamentals and compelling return potential."

With 9M revenues of $128.2M (up 9% YoY) and 9M Adjusted EBITDA of $52.5M (up 10% YoY), Reservoir is tracking toward the upper end of guidance.

Segment Breakdown: Where Is Growth Coming From?

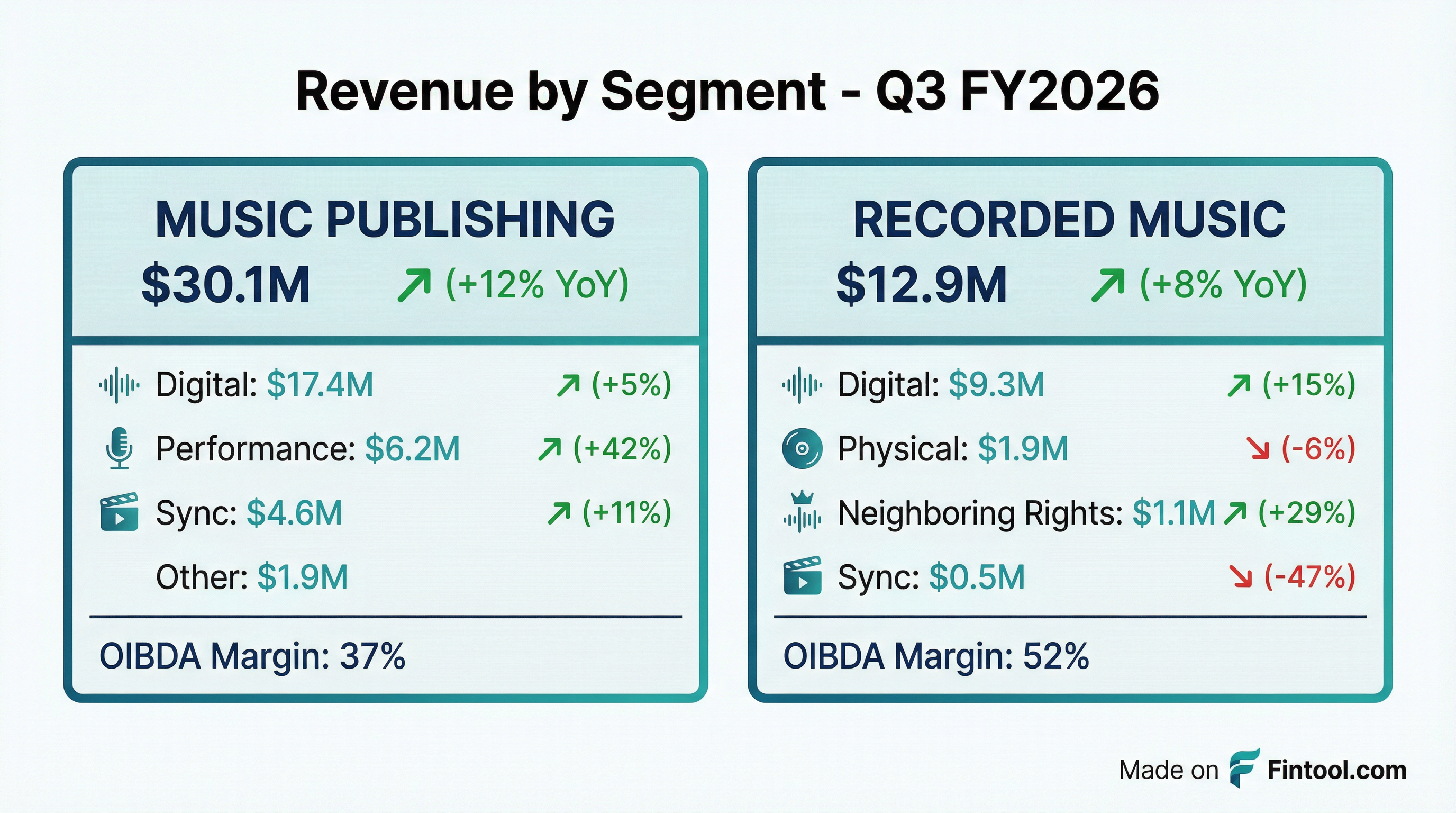

Music Publishing ($30.1M, +12% YoY)

OIBDA Margin: 37% (up from 34%)

The 42% surge in Performance revenue reflects royalty payments from hit songs in Reservoir's catalog. This is the highest-margin revenue stream and drove segment margin expansion.

Recorded Music ($12.9M, +8% YoY)

OIBDA Margin: 52% (down from 53%)

Digital recorded music revenue grew 15% as catalog acquisitions and streaming platform growth continue to drive the business. Physical sales continue their secular decline.

Balance Sheet and Liquidity

Reservoir has been actively deploying capital on catalog acquisitions, which explains the debt increase. The expanded revolver capacity provides headroom for additional deals.

9M Operating Cash Flow: $38.2M, up $5.1M YoY, reflecting improved OIBDA and working capital management.

Key Management Quotes

"We continue to execute our strategy... with a sustained focus on deepening relationships with our top-tier talent through new ventures, investing in the next generation of hitmakers, and expanding our presence in emerging markets."

— Golnar Khosrowshahi, Founder & CEO

"Our confidence to raise our fiscal 2026 guidance as we head into our fourth fiscal quarter is supported by our impressive roster of talent, and we are excited to continue to build upon a successful first three quarters."

— Jim Heindlmeyer, CFO

"Remaining true to our proven capital deployment strategy continues to position Reservoir to provide long-term value as a partner of choice for worldwide talent."

— Jim Heindlmeyer, CFO

Q&A Highlights

M&A pipeline remains strong: CEO Khosrowshahi confirmed deal activity expected to continue "at the same clip" in Q4. When asked about acquisition multiples, she stated there has been no material change to weighted average multiples historically.

Emerging markets offer better economics: "We can acquire at more favorable multiples in the emerging markets... given the expansion and growth projected to continue in those emerging markets, we're looking at some equally more favorable returns on those investments." Latin America pricing is "pretty mature and on par with Western markets."

Industry tailwinds vs. headwinds: CEO noted uncertainty around CRB (Copyright Royalty Board) process, but overall remains positive: "We have tailwinds in subscription number increases, emerging markets expansion, price increases across streaming platforms... we continue to believe that on a net basis, we are looking at tailwinds and continued growth in music."

Activist investor inquiry: When asked about an activist investor's amended 13(d) filing, CEO Khosrowshahi declined to comment: "We're very much focused on continuing to grow the business and delivering value for all of our constituents."

Q4 revenue seasonality: CFO noted Q4 may be down sequentially due to tough comps from royalty recovery audits completed in Q3 and Q4 of the prior year.

Risks and Concerns

-

Rising interest costs: Interest expense of $6.6M in Q3 (vs. $5.8M prior year) is pressuring net income as debt levels increase.

-

Swap volatility: Mark-to-market swings on interest rate swaps are creating earnings noise, though these are non-cash.

-

Mechanical royalty decline: Down 37% YoY, reflecting ongoing challenges in this legacy revenue stream.

-

Synchronization weakness in Recorded Music: Down 47% YoY, suggesting fewer TV/film placements this quarter.

-

Debt levels: Net Debt/EBITDA has increased as acquisitions accelerate. Need to monitor leverage trends.

-

CRB uncertainty: The Copyright Royalty Board process is underway, which could impact royalty rates.

-

Activist investor pressure: An activist has filed an amended 13(d), suggesting potential external pressure on strategy or capital allocation.

Forward Catalysts

- Catalog acquisition pipeline: Management emphasized "strong, diversified pipeline" with deal activity expected at same pace in Q4

- Miles Davis Centennial (2026): Year-long global celebration with brand partnerships, releases, and live performances

- Q4 earnings (early May 2026): Final quarter to close out FY2026 and confirm guidance achievement

- Streaming price increases: Continued tailwind from platform pricing momentum

- Emerging market expansion: India (Pop India), Jamaica (Abood JV), and other high-growth markets

The Bottom Line

Reservoir Media delivered a solid operational quarter with revenue beating by 5.6% and Adjusted EBITDA growing 11% YoY. The EPS miss is a headline risk but driven by non-operational factors (swap losses, interest expense) rather than core business weakness. The guidance raise signals management confidence.

Key question for investors: Can Reservoir maintain its acquisition pace while managing rising interest costs? With Net Debt up $65M this fiscal year and interest expense trending higher, the company's ability to generate cash and service debt becomes increasingly important.

Earnings call held February 4, 2026 at 10:00 AM EST. View Full Transcript